DIY Tax and Accounting System

My Accounting System without an Accountant (Systems Post #4)

For years, I’ve been doing my own accounting system and filing my own taxes. It is always better to have professionals helping you but if you want to explore a Do-It-Yourself tax and accounting system, this is how I do it.

Disclaimer: I am not a financial or tax professional and everything I write is for informational purposes only and might not apply to your situation. Plus, the book I mention has an affiliate link.

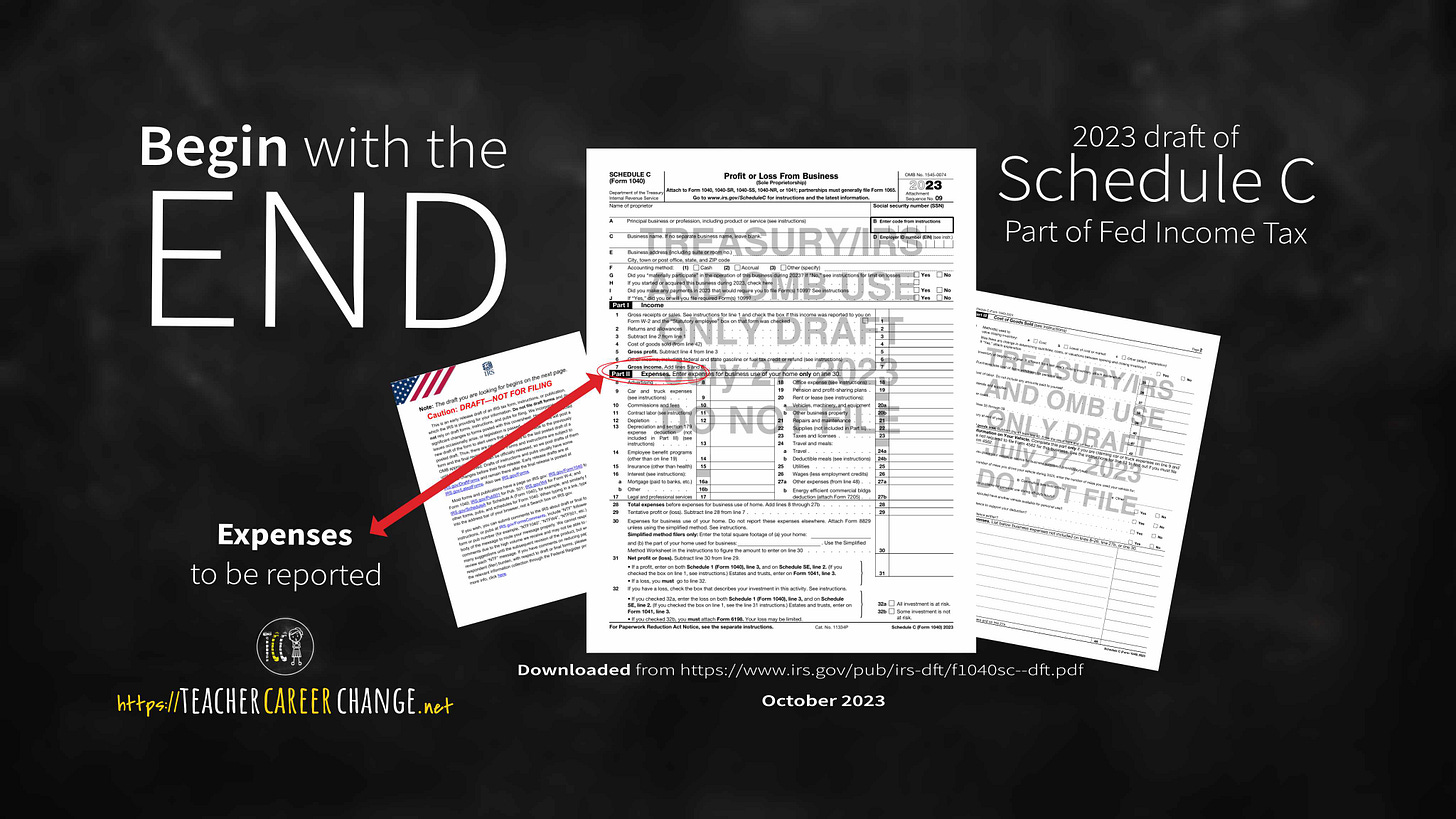

Begin with the End in Mind

In the previous post entitled “Separate Yourself from Your Business”, I mentioned that a Single-Member LLC is a pass-through entity; during tax time, your LLC will be taxed together with your Federal Income Tax (Form 1040). There is an additional form for pass-through businesses, called Schedule C.

Above is a picture of its 2023 draft from the IRS. Zoom in to the red arrow and circle and you’ll find “Expenses.” Those are the group of expenses that IRS recognizes. Thus, I created an accounting system with Schedule C Expenses in mind. Let me explain.

Organization and Flow

Creating systems is all about organization and flow. It is like your classroom groupings. You figure out what is the best approach to teach and group students. Accounting and tax preparation is easier when you group them. Now that you know about Schedule C expenses, learn more about those specific expenses and what are allow and not allowed as business expenditure. You can read the latest IRS filing instructions to know more about each expense. Or you can read Deduct It!: Lower Your Small Business Taxes, a plain english legal book.

GoDaddy Bookkeeping was my former accounting software. I, along with numerous micro-business owners, scrambled to find another service when it closed on June 2022. I haven’t found a comparable service since. Besides, it was only $120 annually and the other apps are more expensive and complicated to use. Here is what it did for my online business before:

automatically collected all sales and fees from Amazon, Etsy and eBay

automatically collected all expenses charge from my Business credit cards

allowed me to upload my receipts as proof of the expenses

categorized all expenses according to Schedule C

computed my quarterly Estimated Self-Employment Tax (you need to pay for this if you are self-employed)

generated Schedule C totals

Unfortunately, I haven’t found a similar accounting app that is as comprehensive and affordable. However, GoDaddy Bookkeeping taught me how to organize and process my business income and expenses. Here is what I do now:

save as PDF all my business receipts that I pay for online and take pictures of receipts I get from face-to-face transactions

save all my receipts in my computer (backed-up in the cloud) which are organized monthly

save all income/payment in the same monthly folder

process all of them by the end of the month using an accounting software

Right now I am using Akounto. I am still looking for an affordable app that will automatically connect with Amazon, Etsy and eBay and collect all the transactions like GoDaddy Bookkeeping. Akounto is great for other type of small businesses.

Tax Filing

What about filing taxes? Well, do you know that IRS has a list of Free File Online providers? I picked one of them and I loved using it ever since. It asks questions then, depending on my answer, it automatically lets me fill out the right additional form. And yes, it prepares Schedule C automatically. The federal income tax form generation and filing is free but I pay around $20 for the state tax filing.

So what about you? As I said, begin with the end in mind. Once you know what taxes you need to pay, it is easy to collect, group and process your receipts. With or without an accountant, it is easier to have an accounting system for your business instead of looking at a pile of receipts you do not want to tackle until tax time. Next post will be about opening new income streams via Amazon KDP under our Creative Wednesday Series. Subscribe for free so you’ll not miss a post.